39 what is bond coupon rate

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate … Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

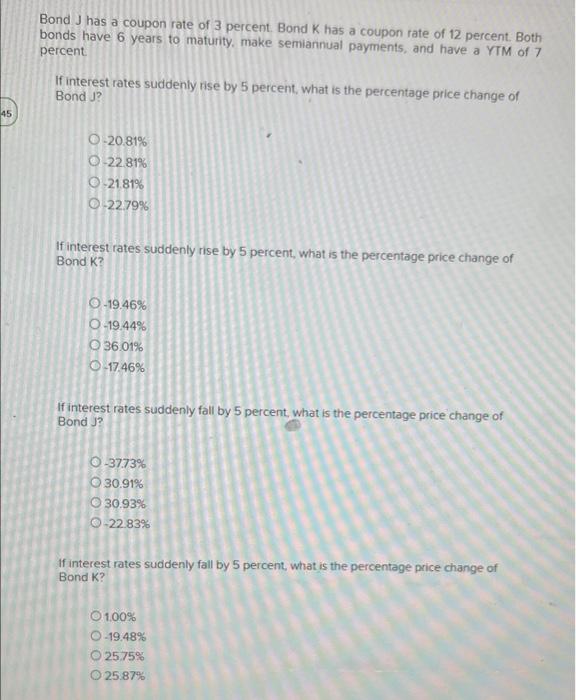

Which Bonds Will Have The Higher Coupon - WhatisAny What does high coupon bonds mean? If a coupon is higher than the prevailing interest rate, the bond's price rises; if the coupon is lower, the bond's price falls. The majority of bonds boast fixed coupon rates that remain stable, regardless of the national interest rate or changes in the economic climate. What determines the coupon rate of ...

What is bond coupon rate

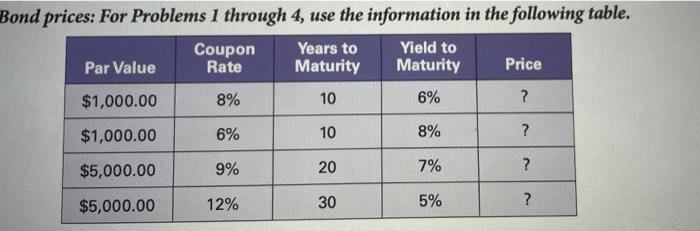

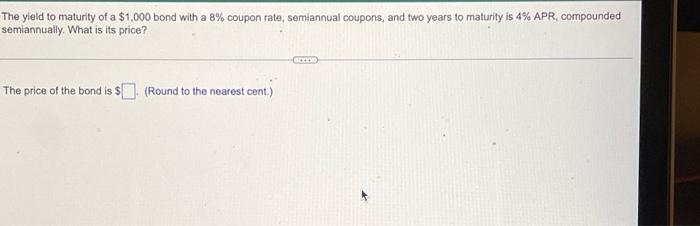

How to Calculate the Price of Coupon Bond? - WallStreetMojo Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2 Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

What is bond coupon rate. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. what is the coupon rate of a bond (paid monthly) with a price of... The coupon rate is the rate of interest that the issuer of a bond pays to the bondholders. The coupon rate is set when the bond is issued, and does not change over the life of the bond. In this case, the coupon rate is 8%, and the bondholders will receive interest payments of $8 per year for each $100 of the bond's face value. Sovereign Gold Bond - Schemes, Price, Returns, Interest Rate 2020 28.4.2021 · However, one can also encash/ redeem the bond after 5th year from the date of issue on coupon payment dates. On maturity: The investor will be advised one month before maturity. On maturity, the gold bonds will be redeemed in Indian rupees based on the selling price published by the Indian Bullion and Jewelers Association Limited. Series I Savings Bonds Rates & Terms: Calculating Interest Rates Series I Savings Bonds Rates & Terms: Calculating Interest Rates. NEWS: The initial interest rate on new Series I savings bonds is 9.62 percent. You can buy I bonds at that rate through October 2022. Learn more.. KEY FACTS: I Bonds can be purchased through October 2022 at the current rate. That rate is applied to the 6 months after the purchase is made.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. What is a Coupon Rate? | Bond Investing | Investment U Coupon rates are the static variable in a dynamic bond market. This makes them an important variable in establishing market rates. The Inverse Relationship Between Price and Yield As bond prices fluctuate and coupon rates stay the same, the yield of a bond changes. This is an extremely important consideration because it changes the value of a bond. Coupon Rate Calculator | Bond Coupon 12.1.2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you … Bond Price Calculator c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders. What Is a Coupon Rate? And How Does It Affects the Price of a Bond? Coupon rate = $500 / $1,000 = 0.05 The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. How the Coupon Rate Affects the Price of a Bond? Every type of bonds does pay interest to bondholder. Such amount of interest is called coupon rate of interest. The coupon rate is fixed over time. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or...

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure.

US 10-Year Government Bond Interest Rate - YCharts 31.1.2022 · US 10-Year Government Bond Interest Rate 2.90% for May 2022 Overview; Interactive Chart; Level Chart. Basic Info. US 10-Year Government Bond Interest Rate is at 2.90%, compared to 2.75% last month and 1.61% last year. This is lower than the long term average of 5.92%. Report: European Long Term ...

Bond Pricer & YTM Calculator - Calculate Bond Prices and Yields Easily ... Coupon Rate = Annual Interest Payment / Bond Market Price. What is Yield to Maturity (YTM)? Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity. Mathematically, it is the discount rate at which the sum of all future cash flows (from coupons and principal ...

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

1. 1) A coupon bond with coupon rate 6% and coupon | Chegg.com 2) You find bond A priced to yield 6%, and a similar-risk bond B priced to yield 6.5%. If you expect the interest. Question: 1. 1) A coupon bond with coupon rate 6% and coupon paid semiannually has a par value of $1,000, matures in 5 years, and is selling today at a $75 discount from par value. What is the price of the bond?

What Is the Coupon Rate of a Bond? 18.11.2021 · Investors can use a bond’s coupon rate to benchmark the level of interest they will receive versus other bonds or interest-bearing investments they might be considering. Article Sources. U.S. Securities Exchange and Commission. …

What Is Coupon Rate and How Do You Calculate It? What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula The coupon rate calculations formula is simple.

Coupon Definition - Investopedia 2.4.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Post a Comment for "39 what is bond coupon rate"