44 treasury bonds coupon rate

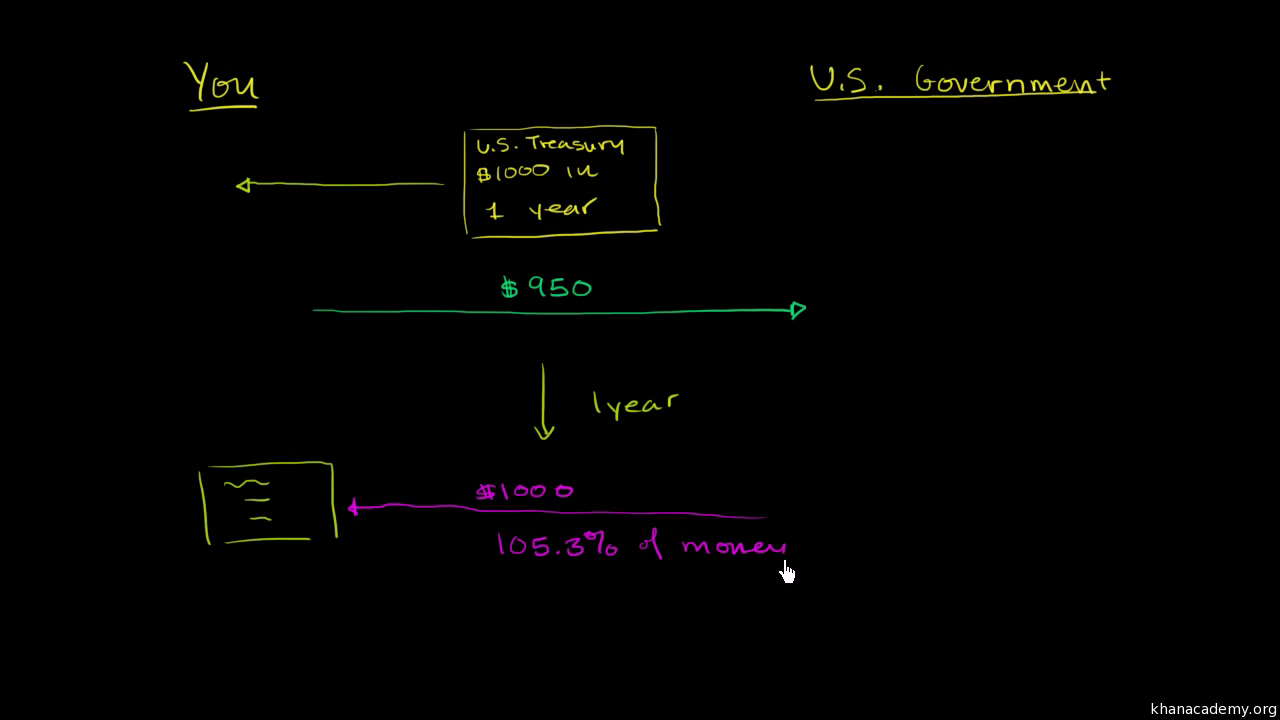

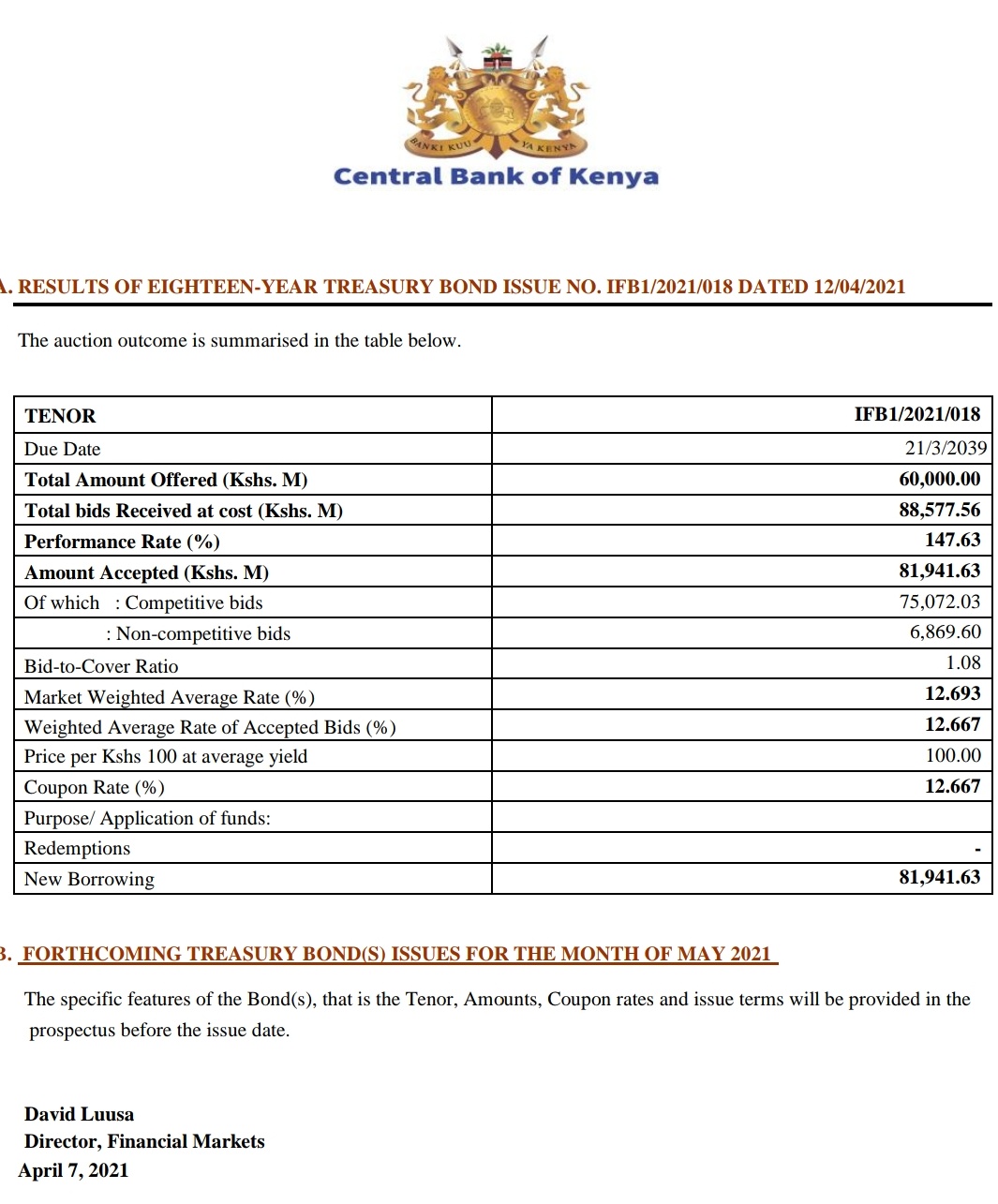

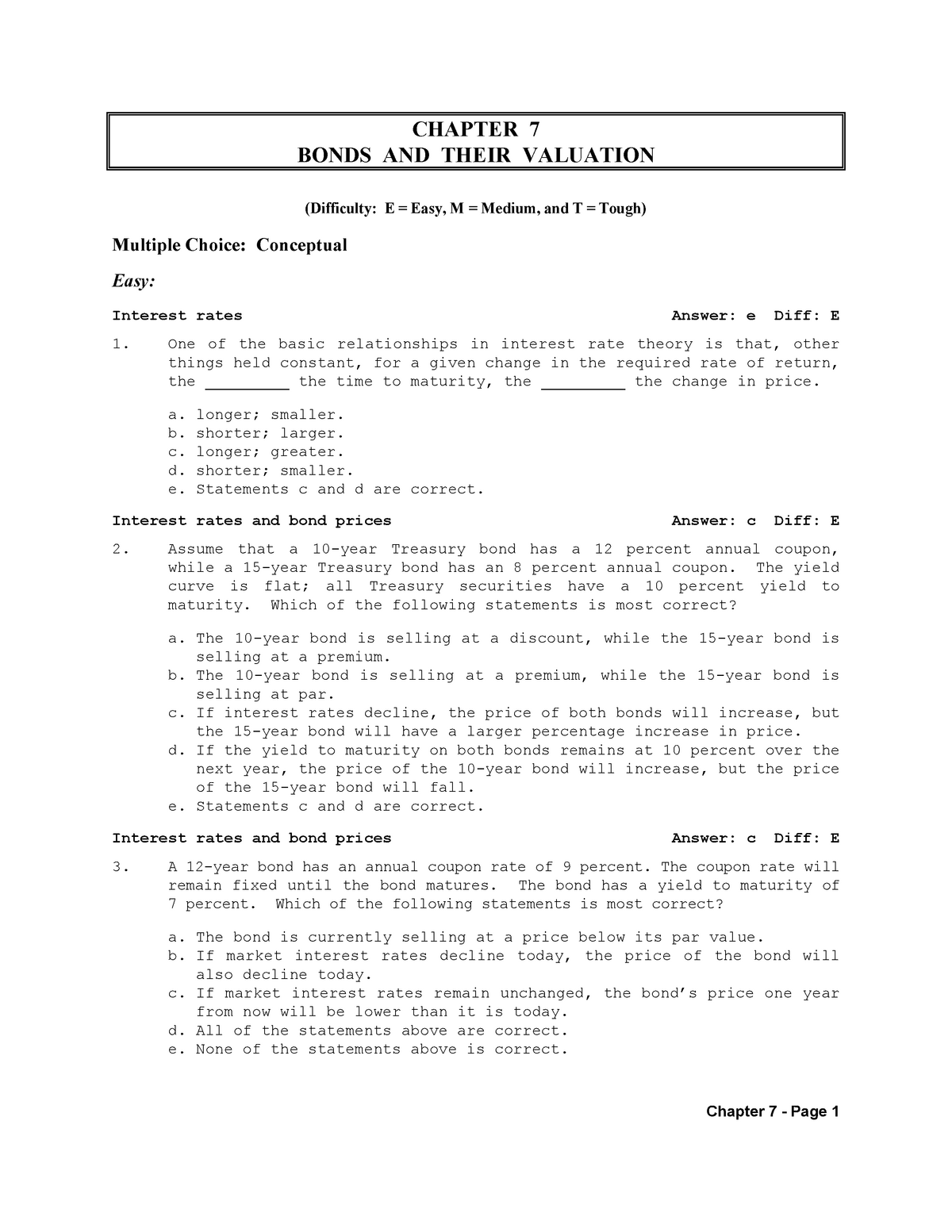

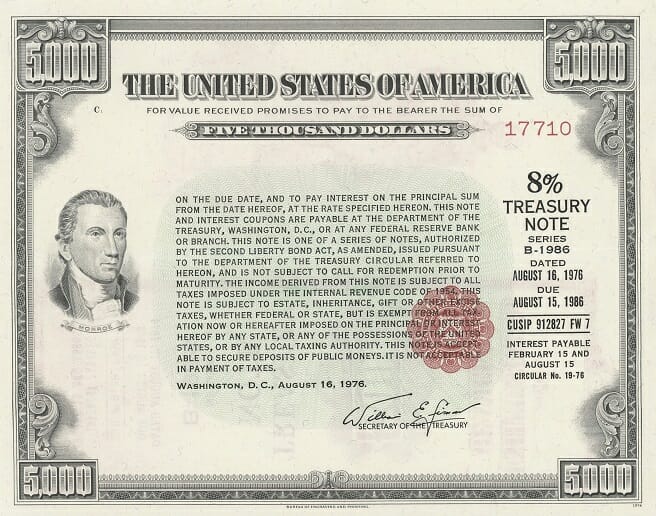

› us-treasury-bondsUS Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Bonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The …

Treasury bonds coupon rate

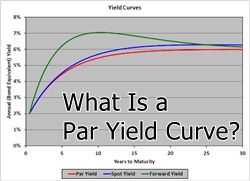

home.treasury.gov › services › bonds-and-securitiesBonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The Bureau of the Fiscal Service The Bureau of the Fiscal ... › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run returns of U.S. Treasuries. ... The Treasury yield is the interest rate that the U ... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury …

Treasury bonds coupon rate. › res_tbond_ratesIndividual - Treasury Bonds: Rates & Terms Aug 15, 2005 · Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) Individual - Treasury Bonds: Rates & Terms 15.8.2005 · Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) › markets › rates-bondsUnited States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . ... Rate Current 1 Year Prior; FDFD:IND ... Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Key Differences between Treasury Bills vs Bonds. Let us Discussed some of the major differences between Treasury Bills vs Bonds: Treasury bills are short term money market instruments whereas Treasury Bonds are long term capital market instruments.; Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to … home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What's the ... 29.3.2022 · There are three ways in which to invest in United States debt: Treasury bonds, Treasury notes, and Treasury bills. The length of time when each matures differs, along with how interest is paid on ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. Bonds with a longer duration are more sensitive to the impact of interest rate shifts. Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with ...

Bonds Center - Bonds quotes, news, screeners and educational Bonds Center - Learn the basics of bond investing, get current quotes, news, commentary and more. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. Bonds with a longer duration are more sensitive to the impact of interest rate shifts. Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with ... United States Rates & Bonds - Bloomberg Find information on government bonds yields, ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . ... Rate Current 1 Year Prior; FDFD:IND . Fed Funds Rate . 2.32: 0.07: Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury …

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run returns of U.S. Treasuries. ... The Treasury yield is the interest rate that the U ...

home.treasury.gov › services › bonds-and-securitiesBonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The Bureau of the Fiscal Service The Bureau of the Fiscal ...

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Post a Comment for "44 treasury bonds coupon rate"